Planulife Investments

Using our A.I. technology, we have done something that has never been done before: We reduced investment expenses to zero

0%

Expences And Management Fees

100%

Investment Secured With Real Estate

$15M+

Direct Investment With No Middle Man

2,000+

Minutes To Onboard And Start Earning

$2M

Flagship Investment Products

Our funds

Our two flagship products allow you to diversify within private real estate to achieve financial freedom

- Risk

- Expected Return

- Registered Account Eligible

- Locked In

- Tax

- Investor type

Planulife Mortgage Income Fund

- Low

- 9% compounded annually

- Yes

- No, fully open

- Income

- All investors

- View Details

Planulife Equity Fund

- High

- 6% - 15%+

- No

- Yes, project duration - 3 to 7 years

- Capital gains

- Accredited investors or existing investors only

- View Details

Planulife Investments

A Mortgage Income Fund is an investment vehicle that uses a pool of capital to issue private mortgages and distributes income to the investors.

These mortgages are secured by something tangible and understandable: residential and commercial real estate.

Our Mortgage Income Fund investment is secured with a pool of housing communities.

Our four investment objectives:

- Capital preservation

- Consistent monthly income

- Avoid volatility of equity markets

- Invest in creating much needed housing supply

Our Companies

Fund Promoter

We connect you with a direct investment

Our technology was developed to cut out the fat. For the first time ever, you will have zero management expense fees on your investment! Traditionally, private real estate expenses range from 5% up to 42%. With our $0 fee structure, 100% of your investment is asset secured and the full income is paid to you.

Investment Administrator

We process and administrate the investment

Lifelong Capital License #12977 licensed with the Financial Services Regulatory Authority of Ontario, underwrites to ensure the Builder has at least 25% stake in the communities for loss protection. As a Mortgage Investment Corporation, under the Income Tax Act Section 130.1, the investment is non-taxable at the corporate level. This ensures optimal returns for our investors.

Home Builder

Provides exclusive access to housing investments

Karmina retains all project risks, such as timelines and construction costs.In our income fund, Karmina risks its investment of over $10M as loss protection to shield investors from losses. As a general contractor, they manage over 30 trades to build quality communities.

Benefits of investing

Consistent Returns

Earn the contract return with zero investment fees

Asset Backed

Every dollar is secured against tangible real estate

Create Housing Supply

Provide housing in your community

Exclusive Access

Priority unit purchase and equity investments

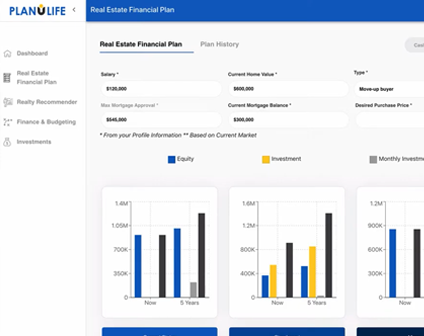

Earnings example

8.25% return on monthly payments. $100,000 investment will yield $687.50 monthly totaling $8,250 in the year. Or, reinvest earnings at 9%, compounding to earn optimal returns.

Karmina Developments Builder Sister Company

Your funds are secured against these 5 housing communities located in the Durham Region, one of the fastest growing regions in Canada. Over the next 10 years, we will build custom homes, townhomes, condominiums, rental apartments, senior livings and commercial units on these properties.

How to invest

For all registered accounts, we use a third party trust company for administration. Simply open your account, purchase our shares and start earning a passive income.

After you have created your new trust account, you can fund the account by transferring your existing registered account or set up a direct withdrawal from your bank account.

Watch this short video for our simple step-by-step onboarding guide.

Accounts that fit your goals

Not sure which accounts are right for you? We'll help you choose!

Frequently asked questions

-

What makes Planulife Investments different from the rest?

Planulife uses technology to cut out all investment or management expenses on its realty investments. 100% of your investment gets secured with real estate that drives returns. We earn through community building as Planulife operates as a free Fund Promoter for our sister companies.

-

How to I set up my account?

Visit https://www.app.planulife.com/investments to create your profile. Add an investment account, either registered or non-registered. E-sign your subscription documents and transfer form, if applicable. Once your account is funded or transferred in, your balance will appear in your dashboard.

-

What investment is suitable for me?

The Mortgage Income Fund has very low principal and return risk and offers flexibility with redemptions processed within 90 days and the option for monthly cash payments or compounded growth. The Fund is a great alternative to GICs, bonds or mutual funds. It’s very suitable for earning cash cheques through TFSA accounts, or projected long term earnings within registered plans such as RRSPs and RESPs.

The Equity Fund also has low risk of principal loss, however lump sum returns fluctuate based on project performance. The Fund is locked in for at least 2 years and is a great alternative to purchasing investment properties or stocks directly. The Fund is suitable for tax deferred investments in non-registered accounts.

-

What companies are involved in Planulife Investments offerings?

Fund promoter - Planulife operates as a free fund promoter.

Investments Administrator - Lifelong Capital Corporation license #12917 with the Financial Services Regulatory Authority.

Builder Partner - Karmina Developments

-

Are there fees for registered accounts (TFSA, RRSP, etc.) administration?

Yes. Planulife uses a third party licensed trust administrator that charges an annual fee. As a welcome bonus, Planulife covers the initial annual fee and one-time share purchase fee.

-

What is the investment minimum?

$25,000. This can come from new deposits from your bank account, or a transfer from existing investment accounts, or both.

-

Where can I track my investments progress?

Investment updates, current balances, history and projected returns can be tracked in our dashboard portal. Visit https://www.app.planulife.com/investments to set up.

Integrated Services

Plan

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sit amet est fringilla, tincidunt est id, pretium ex. Donec pellentesque lorem vehicula tincidunt feugiat.

Learn More

Realty

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sit amet est fringilla, tincidunt est id, pretium ex. Donec pellentesque lorem vehicula tincidunt feugiat.

Learn More

Mortgage

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sit amet est fringilla, tincidunt est id, pretium ex. Donec pellentesque lorem vehicula tincidunt feugiat.

Learn MoreIntegrated Services

Plan

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sit amet est fringilla, tincidunt est id, pretium ex. Donec pellentesque lorem vehicula tincidunt feugiat.

Learn More

Realty

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed sit amet est fringilla, tincidunt est id, pretium ex. Donec pellentesque lorem vehicula tincidunt feugiat.

Learn More